An ETF is an Exchange Traded Fund which includes a basket of securities. More specifically an ETF measures the performance of a group of markets, or an existing market. An increasing number of traders and investors is turning to ETFs to diversify their portfolios. The underlying financial instruments – the core components of the ETF – are readily available at centralized exchanges. Indeed, ETFs are traded (bought and sold) on an exchange. The price of an ETF is determined directly by demand and supply considerations.

In a sense, ETFs trade similarly to shares since they are bought and sold throughout the day at ever-changing prices. Exchange Traded Funds vary according to the investment focus of the fund. There are Fixed-Income ETFs which are generally actively managed and focus on bonds. There are Active Equity ETFs where the manager takes an active hand in managing the components of the ETF. There are also Niche ETFs which can follow the Russell 2000 or subsets of the S&P 500. Diversified Passive Equity ETFs follow benchmark indices such as the S&P 500. For example, ETFs may track certain sectors such as healthcare, energy, or agriculture, or specific commodities such as crude oil, gold, or the US dollar.

ETF trading confers many benefits on traders. For one thing, you get all the diversification (broad exposure) available through mutual funds, at a much lower cost. Plus, ETFs are available with real-time pricing considerations. All ETFs are traded on centralized exchanges such as the NASDAQ, or the NYSE. Your broker facilitates the trade for you. Contrary to popular opinion, trading ETFs isn't an entirely new discipline – you can trade them just like you would trade shares. Buy when you have bullish expectations and sell when you have bearish expectations. With CFD ETFs at 8Invest, that's precisely what you can do, but more of that later!

Since these financial instruments are traded at an official exchange, and these are also funds comprising scores of stocks and/or bonds, they function similar to index funds. Traders and investors love ETFs because they are a terrific diversification option, and they are fully transparent. You are not investing in a single share; you are investing in a known group of shares. This is much safer, since a wrong turn with one share cannot sink your entire ETF holding. This is an effective risk mitigation strategy too. Perhaps one of the most exciting aspects of ETF trading is the hands-off approach. ETFs are taken care of by fund managers; you simply buy or sell the ETF and let them take care of the core components to include in the fund.

What's the Difference between ETFs and Mutual Funds?

For one thing, a mutual fund requires a substantial upfront investment. An ETF requires the purchase of just one share of the ETF. Mutual funds typically execute once a day, after the market closes, but ETFs can be traded throughout the day and during extended hours. Mutual funds typically settle within 1-2 business days, while ETFs typically settle after 2 business days. ETFs and mutual funds differ in terms of short sales, limit orders, and stop orders. While mutual funds do not allow these orders, ETFs do. Mutual funds are managed by professional fund managers. They put together a portfolio of products, and get investors to plough money into the mutual funds. When you buy a mutual fund, there is direct interaction with the fund. With an ETF, there is a secondary market at play.

ETFs are also better suited to active traders. As a registered client at 8Invest, ETFs are definitely the preferred choice. You can buy and sell ETFs at your leisure, without having to hold them for the long-term. ETFs can track a benchmark index as a passive investment, or they can be actively managed and outperform benchmark indexes. Fortunately, anyone can start trading ETFs from as little as $1, and fractional shares are available too. The net asset value (NAV) of ETFs is calculated at the end of the trading day. There is another notable difference between mutual funds and ETFs – pricing. ETF prices are constantly changing. Mutual fund prices stay the same during the day and the prices are reassessed at the close of the day. There are no bid/ask spreads with mutual funds, but there are with ETFs.

At traditional brokers, ETFs can be traded with market orders, or limit orders. It's also possible to place stop limit orders and stop loss orders, with Fill or Kill, or Immediate Fill or Cancel Options. There are no carry sales costs with ETFs, but there are commissions when you execute trades online. In the United States, ETF trading closes at 4 PM Eastern Standard Time (EST), but you can certainly continue trading ETFs after hours, when there are wider bid/ask spreads. With us, you can trade CFD ETFs with WebTrader on PC, Mac, mobile, or tablet, as you wish.

What are the Benefits of ETF Trading at 8Invest?

8Invest is the premier online trading platform for ETFs. Our selection of exchange traded funds covers a wide range of marketable security products. ETFs track pricing of many financial instruments such as indices, commodities, forex, and bonds. Our ETFs are commission free, with fixed spreads. The fee structure for 8Invest ETFs is as follows:

- No deposit fees.

- No withdrawal fees.

- ETFs kept open after 10 PM GMT are subject to funding premiums that are subtracted from the account.

- An inactivity fee of up to $50 per month is applicable when no trading activity takes place for 3 months

- A dormant account maintenance fee of up to $100 per month is applied to accounts inactive for 1 year +.

Indices ETFs at 8Invest include the following indices:

For further information on indices ETFs, click here.

Commodities ETFs at 8Invest include the following:

For further information on commodities ETFs, click here.

How is an CFD ETF traded?

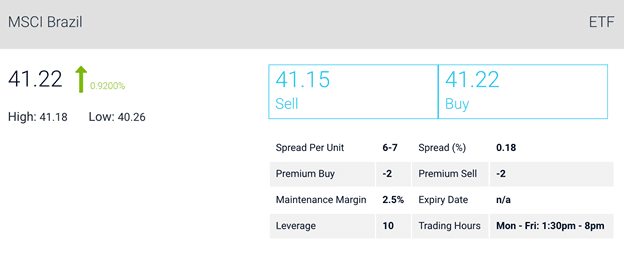

When you look at one of our ETFs, your first decision is whether to buy or sell the CFD ETF. If your technical and financial analysis of the exchange traded fund is bullish (you expect prices to rise), you would buy the ETF. If by contrast, your analysis leads you to believe that the index price will fall in value, you sell the ETF. This means that you are bearish. As you can tell from the MSCI Brazil ETF, leverage of 10:1 is available. This is important, since it indicates how much buying power every $1 of yours has with this particular ETF. $1000 would get you up to $10,000 in leveraged trading. Of course, leverage must be used with caution. Outsized profits to the upside, and losses to the downside are certainly possible.

A CFD is a Contract for Difference. It is a derivatives instrument whose price is derived from the constituent components of the ETF. When you trade CFD ETFs, you are not purchasing the actual shares of these companies, nor are you acquiring ownership of these companies. You are simply trading a contract based on your analysis of the future price movement. From a single position, you can access a broad financial market. These include commodities, indices, bonds, and shares. Thanks to leveraged trades, your capital goes to work much harder for you with CFD ETFs. It also means that you can diversify your portfolio by spreading your limited capital in different types of financial products. Combined, CFD indices, CFD commodities, CFD forex, CFD bonds and CFD ETFs cover a broad cross-section of the market.

8Invest makes it easy for you to amplify your exposure to the market with leverage. Traditional investment options require you to front the full value of the ETF with your own capital. Not so with leveraged trading. The 8Invest solution only requires 10% margin for indices, and 2% margin for commodities. This means that if you wish to trade $1000 worth of MSCI Brazil ETFs, your capital requirement is $100 upfront. If you wish to trade $1000 worth of the USO-Oil Fund ETF, your upfront capital contribution is $20. Once the CFD is active, a margin call may be required if the trade starts to move in the opposite direction (against you). This means that capital in your account will be used to keep the trade open, or the open position will be closed out.

What are the Most Popular ETFs?

There are scores of ETFs at centralized exchanges such as the NYSE, and NASDAQ. Popular options include the iShares US Energy ETF, iShares Core S&P 500 ETF, Global X Cannabis ETF, Vanguard Total International Stock ETF, SPDR Gold Shares, SPDR S&P 500 ETF Trust, Invesco QQQ Trust, and the Vanguard FTSE Emerging Markets ETF. ETF popularity can be assessed by assets under management (AUM). The biggest funds tend to drive the most interest among traders. With ETFs, there are often differences between the Net Asset Value (NAV) of constituent components, and the market capitalization of the fund. This results in premiums and discounts in the trading price.

What ETF is Best for You?

We understand that it can be overwhelming choosing from thousands of ETFs. That's why we have picked a handful of indices ETFs and commodities ETFs to narrow the focus. When you are looking to trade an ETF (buy or sell), always consider the following factors:

- ETF exposure with leverage

- Derivatives ETFs or physical ETFs

- The market capitalization of the ETF

- The types of assets under management

- Your appetite for risk determines your preferred ETF

There are many different types of ETFs beyond what we have listed. These include geographic ETFs, sector ETFs, industry ETFs, currency ETFs, inverse/short ETFs, leveraged ETFs, and the like. Since our focus is limited to indices and commodities, you can fine tune your understanding of these markets for your financial portfolio. Trading ETFs with derivatives like CFDs can be beneficial provided you make the right calls.

It is wise to conduct all the necessary research before placing Buy or Sell orders with CFDs. Use leverage carefully to amplify your gains, and guard against incurring losses. Remember, losses are calculated on the full value of the position, not just the margin requirement to initiate the trade. Implement effective risk management strategies, and over time you will be trading ETFs like a champion.