They say that money makes the world go around, and it's true! Forex trading is the biggest market in the world, by a long margin. Just recently, it emerged that the foreign exchange market a.k.a. the forex market enjoys trading volumes of up to $6.6 trillion daily*. These numbers dwarf the total combined trading activity of stocks, commodities, cryptocurrencies, and indices. The forex market is a hive of activity, with retail and institutional traders making up the lion's share of activity.

Every country uses a currency for transactions purposes. When international trades take place, currencies are exchanged. There are major currency pairs, minor currency pairs, and exotic currency pairs. Every forex transaction includes a base currency and a quote currency. The most heavily traded currency pairs include combinations of the USD, EUR, GBP, JPY, CAD, NZD, AUD, CHF, and KRW.

*The Triennial Central Bank Survey of FX and OTC Derivatives from 2019

Base Currencies and Quote Currencies

Recall that every forex trade involves two currencies – the base currency and the quote currency. The base currency is the first currency in the pair. As an example, consider the EUR/USD pair. The EUR is considered the base currency. In this pair, the EUR is always designated as 1 unit (€1) and USD amount (US $) represents the amount of US dollars required to purchase €1. If the EUR/USD is trading at 1.1865, that means that €1 is worth $1.1865.

Take note that currencies are always quoted to the fourth decimal place. That's what a PIP (percentage in point) is known as. It is the smallest possible price movement for a forex pair. The PIP represents the fourth decimal point, and it's the equivalent of 1/100 of 1%. It's an incredibly small amount, but when you’re trading currency pairs with leverage, these PIP movements can have outsized impacts on profits and losses.

When you trade forex, you are buying or selling the base currency and the counter currency. Let's say you believe that the European Central Bank (ECB) will raise interest rates in the near term. This bodes well for the EUR, so you decide to buy (Go Long) on the EUR/USD pair. This means you buy the EUR, and you sell the USD. Your expectation is that the base currency will rise and the quote currency will fall. If the Federal Reserve Bank is expected to raise interest rates, you might decide to sell the EUR/USD. This means you would sell the base currency (EUR) and buy the quote currency (USD).

The World's Top 10 Most Traded Forex Pairs

The world's biggest economies such as the US, Europe, UK, Japan, Canada, and China are naturally responsible for most forex trading activity. Therefore, in order of volume, the top 10 most traded forex pairs have been reported by the Bank for International Settlements (BIS) Triennial Survey of 2019:

- EUR/USD - the EURO and US dollar

- USD/JPY - the US dollar and the Japanese yen

- GBP/USD - the British pound and the US dollar

- AUD/USD - the Australian dollar and the US dollar

- USD/CAD - the US dollar and the Canadian dollar

- USD/CNY - the US dollar and the Chinese renminbi

- USD/CHF - the US dollar and the Swiss franc

- USD/HKD - the US dollar and the Hong Kong dollar

- EUR/GBP - the euro and the British pound

- USD/KRW - the US dollar and the South Korean won

Note that there may be changes in the trading volumes for the top 10 most traded FX pairs, but these currencies remain the ranking currencies in the forex markets. We can divide currencies into different categories, including Major Currencies, Minor Currencies, and Exotic Currencies. Let's take a look at each designation and how important they are vis-a-vis forex trading.

Major Currencies

Forex majors, also known as major currencies include a combination of 8 major currency pairs (although many brokers highlight 6, or 7) that are traded on a daily basis. This list includes the following: GBP/USD, USD/CAD, EUR/USD, NZD/USD, AUD/USD, USD/CHF and USD/JPY. Notice that the USD features as either the base currency, or the quote currency in each of the major currencies. These are the FX markets most heavily traded currency pairs on a daily basis. They feature much lower volatility than lesser-traded FX pairs, and they have the highest levels of liquidity.

Minor Currencies

Forex minors – as the name suggests – are lesser-traded currency pairs. However, there are significant trading volumes with minor currencies. Characteristics of minor currency pairs include lower levels of liquidity, wider spreads, and greater volatility. They do not include the US dollar as the base currency, or the quote currency. However, there is at least one of the world's three top currencies included in minor currencies. These currencies include the Japanese Yen (JPY), Euro (EUR), and the British pound (GBP).

Minor currency pairs include the likes of EUR/GBP, UD/JPY EUR/CHF, EUR/CAD, GBP/JPY, CAD/JPY, CHF/JPY, NZD/JPY et cetera. Naturally, the most actively traded minor currency pairs are those including the three forex majors – the Japanese yen, the British pound, and the Euro.

Exotic Currencies

Exotic currency pairs usually include the currencies of emerging market economies and major currencies. There are many such examples of exotic currency pairs such as the USD/DKK, USD/SGD, USD/NOK, GBP/ZAR, AUD/MXN, USD/THB, and JPY/NOK. It's a good idea to make sure you understand the abbreviations for currencies, as determined by the International Organisation for Standardization ISO 4217.

ISO Codes for the 15 Most Traded Currencies by Value

- United States dollar – USD

- Euro – EUR

- Japanese Yen – JPY

- Pound Sterling – GBP

- Australian dollar – AUD

- Canadian dollar – CAD

- Swiss franc – CHF

- Chinese Renminbi – CNY

- Hong Kong dollar – HKD

- New Zealand dollar – NZD

- Swedish Krona – SEK

- South Korean won – KRW

- Singapore dollar – SGD

- Norwegian krone - NOK

- Mexican peso – MXN

What are the Benefits of Trading Forex Online at 8Invest?

8Invest is an industry-leading forex broker with over a decade of experience in the game. Our trading professionals have created a powerful set of platforms including 8Invest WebTrader (browser-based forex platform), and Mobile Trading Apps for Android, iOS devices and tablets. These cutting-edge platforms are packed full of features and trading resources for instant execution of trades, real-time price quotes, and access to in-depth market analysis.

8Invest is positioned at the forefront of the forex trading industry, for retail traders. We have crafted an innovative trading platform with competitive spreads and margins on a wide range of forex options. Our forex CFD options allow you to profit from rising or falling forex markets. Please be advised that CFDs are derivatives and losses can result too. You can easily employ technical and fundamental analysis of the currency market to your trades. Plus, there are no commissions and fixed spreads at 8Invest. This eliminates unnecessary costs and allows you to pocket more of your profits.

The Fee Structure at 8Invest:

- No Deposit Fees

- No Withdrawal Fees

- Inactivity Fee of up to $50 per month if your account is inactive for more than 3 monthsY

- Dormant Account Maintenance Fees of up to $100 per month if your account is inactive for 1 year +

At 8Invest, clients only pay the spread – the difference between the bid and ask prices. Clients are welcome to see the spread for forex pairs, minor pairs, and exotic pairs by clicking this link.

There are Premium Charges applied to traders if a position is kept after 10 PM GMT (9 PM DST).

Forex Trading with Leverage at 8Invest

It's quick and easy to open an account at 8Invest. In fact, the whole process can take just 2 minutes. You can fund your account with Bank Transfer, Credit Cards, or Skrill. We offer forex CFDs for major pairs, minor pairs, and exotic currency pairs. Click here for a full list of our forex CFDs. There are Premium Charges applied to traders if a position is kept after 10 PM GMT (9 PM DST).

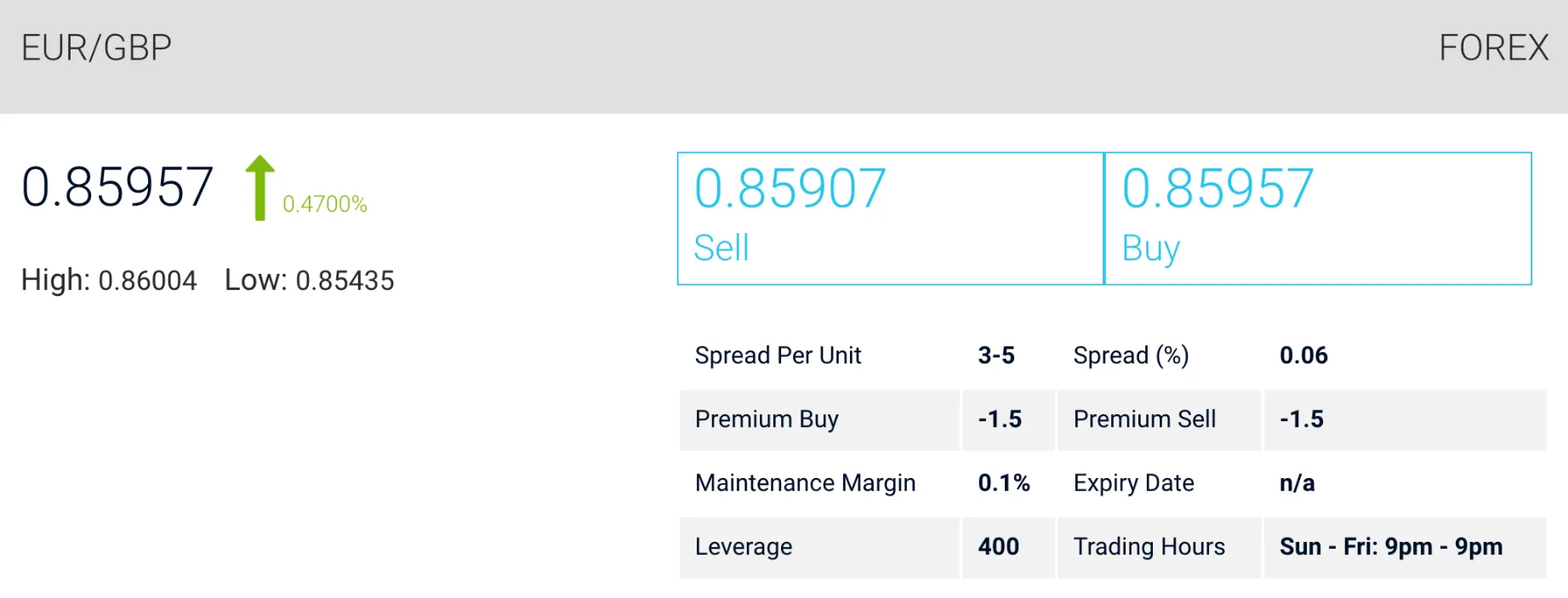

CFD trading is a derivatives product which mirrors the trade price of the underlying financial instruments such as the EUR/GBP pair. You simply click sell if you wish to sell the EUR and buy the GBP (go short on the EUR), or you click buy (go long on the EUR) and sell the GBP.

The EUR/GBP can be traded with leverage of up to 1:400. That means that $1 has the buying power of $400 worth of EUR/GBP. Forex CFD trading does not confer ownership of actual currency; you're simply trading a contract with speculative assessments of pricing.

CFD trading is a derivatives product which mirrors the trade price of the underlying financial instruments such as the EUR/GBP pair. You simply click sell if you wish to sell the EUR and buy the GBP (go short on the EUR), or you click buy (go long on the EUR) and sell the GBP.

If your technical and fundamental analysis lead you to believe that the EUR will strengthen relative to the GBP, you adopt a bullish perspective and buy this minor pair. If your assessment leads you to believe that the British pound will strengthen relative to the euro, you buy the British pound and sell the euro.

With CFD trading, leverage allows you to take a much bigger stake in a trade than your capital would traditionally permit. It's a great way to diversify your portfolio, especially with highly volatile financial instruments like forex. You can spread your capital around between forex CFDs, commodity CFDs, indices CFDs, and share CFDs. That way, you've got your proverbial finger in many different pies. This risk mitigation forex strategy will serve you well when markets don't perform according to expectations. Luckily, you can trade to the upside or downside with CFDs and profit accordingly.

The margin requirement is effectively 1÷400 = 0.25% on the EUR/GBP. This means that you have to put down 0.25% of the value of the trade in order to open that position. Be advised that leverage and margin will vary depending on the financial instruments you are trading. For example, exotic forex pairs like the EUR/ZAR are far less liquid and much more volatile – therefore the leverage is 1:100 at 8Invest.

Forex trading TIP: You always get better leverage with the major pairs than you do with the minor pairs, or the exotic pairs at 8Invest.

Checklist for Trading Forex Online

The forex market is the world's most heavily-traded market. It is also extremely volatile, so caution is advised. Your success in forex trading hinges upon several factors, notably your knowledge and understanding of the forex markets. Take the time to read up about your preferred currency pairs, and the macroeconomic variables (GDP, interest rates, inflation rate, employment figures, etcetera) that may influence prices. It's always a good idea to use charts, graphs, and fundamental analysis when trading forex. Luckily, you can practice on free demo accounts right here at 8Invest.

Our intuitive trading platforms are designed for PC, Mac, and mobile usage. We strongly encourage you to use all the technical tools at your disposal, including Moving Average Convergence Divergence (MACD), Bollinger Bands, Fibonacci Retracement, Relative Strength Index (RSI), and others while trading forex online.

Self-discipline is equally important. You will need to keep a journal of all your forex trades, and make a note of why trades finished in the money, or out of the money. Trade with your head, not your heart. We encourage a healthy appetite for knowledge – the more you learn, the better your trading outcomes. Above all else, put in the time and have contingency plans in place to protect your financial portfolio.

Now you are ready to tackle the forex market like a champion. 8Invest is here for you, every step of the way. When you buy and sell forex pairs, know that you are in safe hands with 8Invest’s powerful platforms.